Every company generates business documents. Cataloging and storing paper files, electronic documents, correspondence, and data used in business applications and databases takes time, effort, and money. However, not all business records are of equal value — some can be safely discarded in time while others must be retained.

Federal, state, and local laws and regulations — tax, employee benefit, occupational safety, wage and hour, etc. — require businesses to hold on to various documents for specific periods. Beyond these requirements, it makes sense to retain other records that help document and support management decisions and actions should they ever be the subject of a lawsuit. Moreover, accurate records can be very helpful to prospective buyers or investors as you prepare to expand your business.

Benefits

A document retention policy can streamline the process of choosing documents for retention or destruction and minimize the risk that important documents will be inadvertently destroyed. A good record retention policy can:

• Reduce legal risks, discovery costs, and recovery effort time associated with lawsuits.

• Minimize rental or lease expenses for storage space, utilities, and maintenance.

• Reduce the risk of destruction of physical and electronic records due to natural disasters.

• Minimize the labor costs associated with cataloging and maintaining records.

Creating a Policy

Here are some suggestions for creating and implementing an effective document retention policy.

Develop a List.

Identify the documents that you should consider and draw up the reasons why these documents should be retained or destroyed. Consider and review employee records, employment tax records, training manuals, safety documents, maintenance records, product manuals, travel and delivery schedules, accounting and corporate tax records, legal documents, real estate records, contracts, records of administrative penalties, litigation-related documents, insurance policies, licenses and permits, government paperwork, and vehicle registrations. Don’t forget to include electronic records, such as hard drives, discs, emails, and other forms of electronic correspondence.

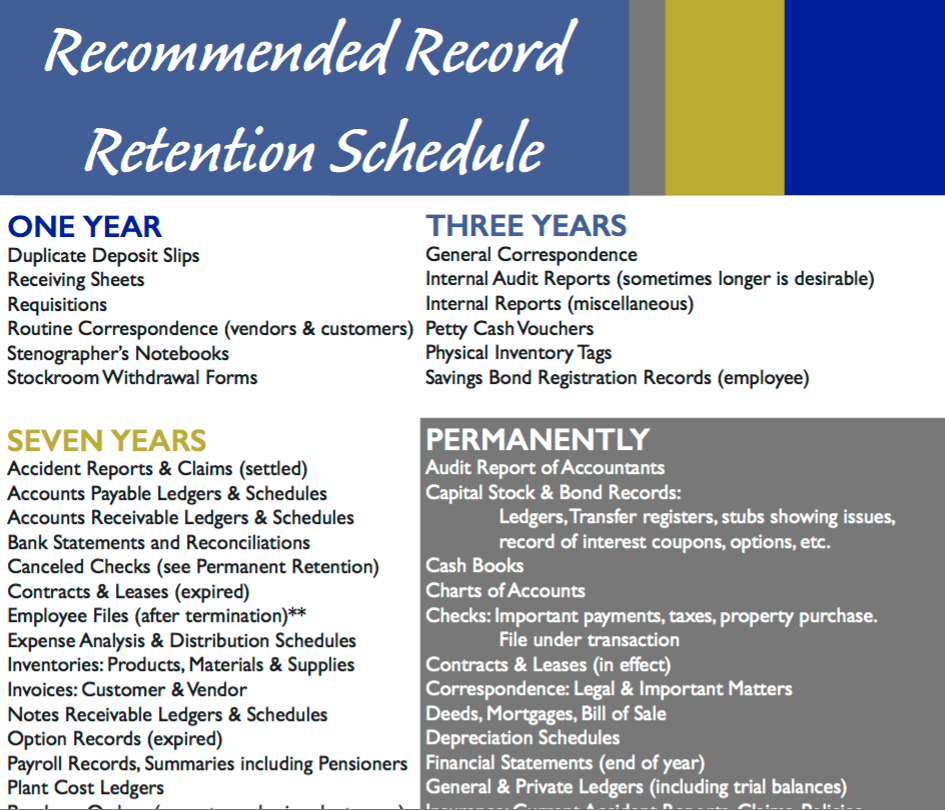

Determine Retention Periods.

Consider federal, state, and local laws and regulations when deciding how long your business should keep documents and records. In addition, identify those records you may need to keep indefinitely to support your business in case of a lawsuit, explain business decisions, and assist your business in case of a sale.

Evaluate Storage Options.

When you are deciding how and where to store documents, weigh issues such as the expense of storage, security, and the ease of retrieving documents.

Enforce the Policy.

All employees should read, understand, and apply the parts of the document retention policy that affect them. The policy should be followed consistently and enforced at every level of your company. Consistent adher