Newsletters and Guides

Newsletters

Tax+Business Alert – July 23rd, 2024

View and sign up for our latest Tax+Business Alert newsletter. Headlines in this edition include the following: If Your Business ...

Tax+Business Alert – July 9th, 2024

View and sign up for our latest Tax+Business Alert newsletter. Headlines in this edition include the following: SECURE 2.0: Which ...

Tax+Business Alert – June 25th, 2024

View and sign up for our latest Tax+Business Alert newsletter. Headlines in this edition include the following: Figuring Corporate Estimated ...

Tax+Business Alert – June 11th, 2024

View and sign up for our latest Tax+Business Alert newsletter. Headlines in this edition include the following: Inflation Enhances the ...

Employee Benefit Plan Resources – May 2024

View and sign up for our latest Employee Benefit Plan (EBP) Resources newsletter. Headlines in this May 2024 edition include ...

Tax+Business Alert – May 28th, 2024

View and sign up for our latest Tax+Business Alert newsletter. Headlines in this edition include the following: Tax Tips When ...

Nonprofit Connection Newsletter: May 2024

In this May 2024 Nonprofit Connection newsletter, our CPAs provide updates and coverage of the following topics: How to Manage ...

Tax+Business Alert – May 14th, 2024

View and sign up for our latest Tax+Business Alert newsletter. Headlines in this edition include the following: Growing Your Business ...

Tax+Business Alert – April 30, 2024

View and sign up for our latest Tax+Business Alert newsletter. Headlines in this edition include the following: When Businesses May ...

Tax+Business Alert – April 16, 2024

View and sign up for our latest Tax+Business Alert newsletter. Headlines in this edition include the following: Scrupulous Records and ...

Guides

2024 Key Tax Fact Sheet

Download our 2024 Key Tax Fact Sheet to ensure you’re up to date. Rates included: Social Security, Medicare and Federal ...

Employee Benefit Plan and IRA Quick Reference Table

The Internal Revenue Service has announced the cost-of-living adjustments applicable to dollar limitations for various qualified retirement plans and other ...

2023-2024 Tax Planning Guide

View our 2023-2024 Tax Planning Guide to ensure you’re up to date. Rates included: 2023 Tax Climate Introduction - 2 ...

2023 Key Tax Fact Sheet

Download our 2023 Key Tax Fact Sheet to ensure you’re up to date. Rates included: Social Security, Medicare and Federal ...

2022 Key Tax Fact Sheet

Download our 2022 Key Tax Fact Sheet to ensure you’re up to date. Updated to include 7-1 mileage rate. Rates ...

Employee Retention Credit (ERC): Quick Reference Guide

Congress has issued new legislation to help struggling employers and individuals. One key component, in the Consolidated Appropriations Act (CAA) ...

Recommended Record Retention Schedule

View and/or print our recommended record retention schedule by clicking here. Download Here ...

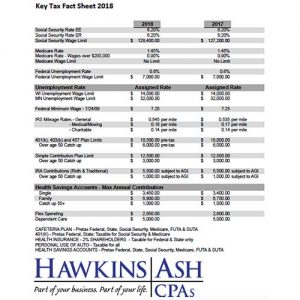

2021 Key Tax Fact Sheet

Download our 2021 Key Tax Fact Sheet to ensure you’re up to date. Rates included: Social Security, Medicare and Federal ...

Not-for-Profit: Revenue Recognition Standard

In May 2014, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update (ASU) 2014-09 - Revenue from Contracts with ...

Lease Standard Effects on Lessee

In February 2016, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update (ASU) 2016-02 – Leases (Topic 842) which ...

2019 Key Tax Fact Sheet

Download our 2019 Key Tax Fact Sheet to ensure you’re up to date. Rates included: Social Security, Medicare and Federal ...

General Business: Revenue Recognition Standard

The recognition of revenue under current accounting standards requires the consideration of two factors; being realized or realizable and being ...

Manufacturers: Revenue Recognition Standard

The recognition of revenue under current accounting standards requires the consideration of two factors; being realized or realizable and being ...

Retailers: Revenue Recognition Standard

The recognition of revenue under current accounting standards requires the consideration of two factors; being realized or realizable and being ...

Contractors: Revenue Recognition Standard

The recognition of revenue under current accounting standards requires the consideration of two factors; being realized or realizable and being ...

Financial Institutions: Revenue Recognition Standard

The recognition of revenue under current accounting standards requires the consideration of two factors; being realized or realizable and being ...

Guide: Travel Expense Deductions

Many taxpayers have the same question when it comes to travel, meal, and vehicle expenses. "These expenses are tax-deductible, right?" ...

Guide: Exercising Corporate Due Diligence

Proper due diligence ensures the benefits of the business structure will be upheld if challenged from a legal or tax ...