Congress has issued new legislation to help struggling employers and individuals. One key component, in the Consolidated Appropriations Act (CAA) of 2021, is the extension of and major changes to the Employee Retention Credit (ERC). A major change to the CAA now allows employers who receive or previously received a PPP loan to claim the ERC. This allows employers, that were previously ineligible, to go back and claim the 2020 ERC. It’s important to note that the same wages cannot be used to apply for PPP loan forgiveness, other tax credits, most types of federal or state funding, and the ERC. To maximize an employer’s overall financial assistance, a well-planned strategy can be used to allocate expenses to these various funding sources.

There are still parts of this legislation that need further guidance, such as how to retroactively claim these credits and the interplay with already forgiven PPP loans. Please contact us for further information or ask about how the Employee Retention Credit (ERC) can create an opportunity for funding.

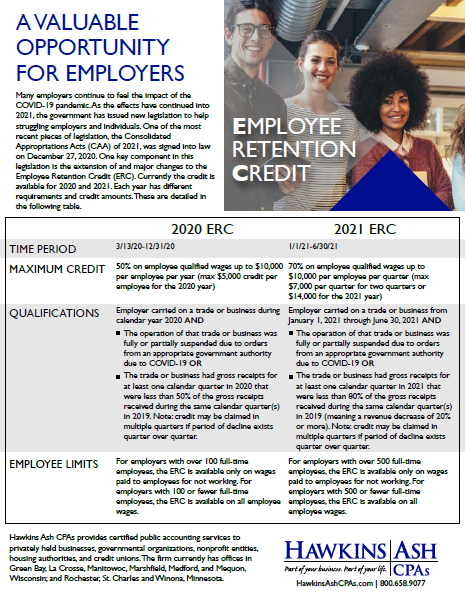

View the Employee Retention Credit Quick Reference Table.