2020 is well underway and employers should now be using the latest version of Form W-4 Employee’s Withholding Certificate. This IRS form needed to be revised in order to more accurately calculate withholding due to the tax law changes made late in 2017.

The new W-4 can be completed using a simple method or a more comprehensive method, as outlined in this article by Robin Lutz, MT, CPA, Senior Tax Manager at Hawkins Ash CPAs. Either way, it is easy to enter into QuickBooks Desktop.

- Go to the top menu bar and click Employees, then Employee Center.

- Double-click the employee you need to update.

- Click the Payroll Info tab, then Taxes in the upper right-hand corner.

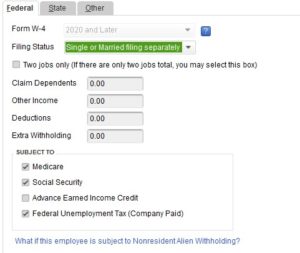

Note that QuickBooks currently has the default option set to 2019 and Prior for the form type. You will need to click the drop-down and select 2020 and Later.

You may receive a pop-up letting you know the following before you proceed:

- Hire date is on or after Jan. 1 of 2020.

- You will not be able to switch back to the 2019 version.

If the person is Single and holds more than one job, or if they are filing Married filing jointly and their spouse also has a job, then they can check the box.

If they did not check the box, they very well could have gone through the estimator or the multiple jobs worksheet and entered information in the optional Other Income, Deductions or Extra Withholding field(s).

If they Claim Dependents, have Other Income or Deductions, or want to withhold extra, you will enter that information based on what they have filled out.

Sometimes there are cases when you will receive a W-4 that has only the Filing Status filled out—and that is okay. Not everyone may have a second job, household or dependents.

After this information is entered, employees also need to fill out a withholding form for their state to record their filing status and allowances for state withholding.

As always, feel free to contact us with any QuickBooks Desktop questions or let us assist you with helping your employees understand this new W-4 form for use in the months ahead.