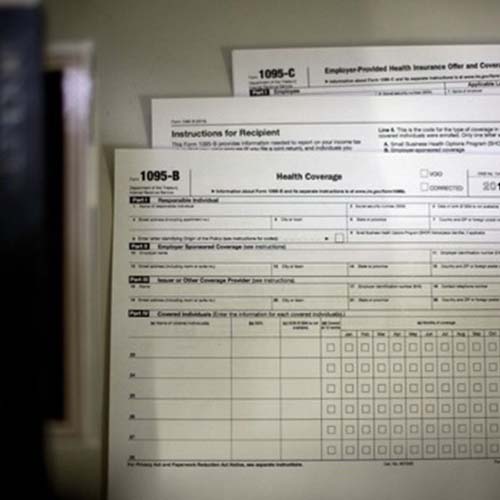

Lance Campbell, CPA and partner-in-charge of our Rochester office, provides insight into how the IRS handles ACA documentation on your tax return.

“If they don’t check [the box] and don’t fill out the forms, it will not show a penalty on the return and the return will get accepted by the IRS,” said Lance Campbell, a certified public accountant with Hawkins Ash CPAs in Rochester. “But then … you may get something down the road if you leave it silent.”