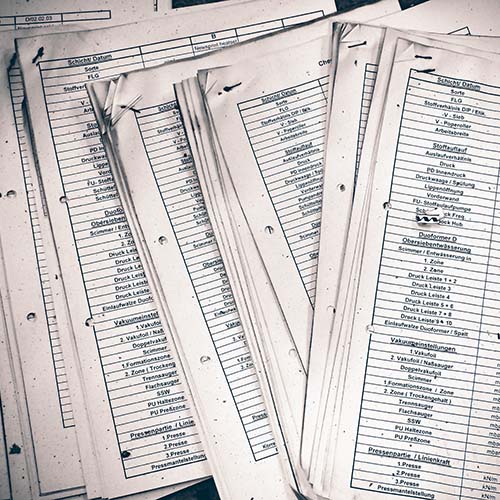

Spring is in the air! It’s a great time to organize your financial records. And the keyword here is indeed “organize.” Throwing all your important documents into a drawer won’t help much when an emergency occurs and you (or a family member) need to find a certain piece of paper.

Make a List

Of course, emergencies aren’t the only reason to organize your financial records. For example, you may need to be able to access relevant personal records if you’re ever audited or a victim of theft. Or your home could be damaged in a storm or fire. Or you may need proof to cash in investments or claim insurance benefits.

To get started, make a list of important records. These include items related to:

- Bank and investment accounts,

- Real estate and homeownership,

- Insurance policies,

- Credit card accounts,

- Health care benefits and medical history, and

- Marriage and your estate.

- Grouping the items into broad categories such as these will make them easier to file and find later.

Establish Your Approach

With your list in hand, it’s time to start organizing and storing your records. Here are some tips for streamlining the process:

- Create a central filing system. The ideal storage medium for personal documents is a fire-, water- and impact-resistant security cabinet or safe. Create a master list of the cabinet contents and provide a copy of the key to your executor or a trusted family member.

- Designate a second storage location. Maintain a duplicate set of the records in another location, such as a bank safety deposit box, and provide access to a trusted individual (preferably not the same individual with access to the original documents). Consider keeping originals of your important legal documents, such as your will, with your attorney.

- Back up records electronically. It also makes sense to store copies of records electronically. Simply scan your documents and save them to a trustworthy external storage device. If opting for a cloud-based backup system, choose your provider carefully to ensure its security measures are as stringent as possible.

Follow the Ritual

Make organizing your records an annual ritual and not just a one-time event. Need assistance? We can help you identify the specific documents pertinent to your situation and organize them appropriately.