Just before recessing for the holidays, the House and Senate passed the Protecting Americans from Tax Hikes Act of 2015 (PATH Act). President Obama is expected to sign the bill as soon as it reaches the White House. The Act does considerably more than the typical tax extenders legislation seen in prior years. It makes permanent over 20 key provisions, including the research tax credit, enhanced Code Sec. 179 expensing, and the American Opportunity Tax Credit. It also extends other provisions, including bonus depreciation, for five years; and revives many others for two years. In addition, many extenders have been enhanced. Further, Act imposes a two-year moratorium on the ACA medical device excise tax.

Just before recessing for the holidays, the House and Senate passed the Protecting Americans from Tax Hikes Act of 2015 (PATH Act). President Obama is expected to sign the bill as soon as it reaches the White House. The Act does considerably more than the typical tax extenders legislation seen in prior years. It makes permanent over 20 key provisions, including the research tax credit, enhanced Code Sec. 179 expensing, and the American Opportunity Tax Credit. It also extends other provisions, including bonus depreciation, for five years; and revives many others for two years. In addition, many extenders have been enhanced. Further, Act imposes a two-year moratorium on the ACA medical device excise tax.

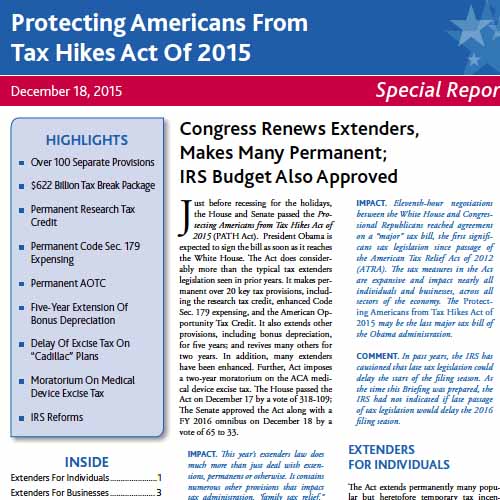

Please review this special report on the Protecting Americans from Tax Hikes of 2015.

Highlights include:

- Over 100 Separate Provisions

- $622 Billion Tax Break Package

- Permanent Research Tax Credit

- Permanent Code Sec. 179 Expensing

- Permanent AOTC

- Five-Year Extension of Bonus Depreciation

- Delay of Excise Tax on “Cadillac” Plans

- Moratorium on Medical Device Excise Tax

- IRS Reforms