The 2016 Wisconsin Unemployment Tax Rate notifications were mailed in October. If your state unemployment insurance rate changes for 2016, you will need to update your payroll item. Please make this change immediately in your QuickBooks.The 2016 Minnesota Unemployment Tax Rate notifications will be mailed in December.

- On the top menu bar, click Lists, Payroll Item List, and scroll down to double click the WI (or MN)- Unemployment Company payroll item.

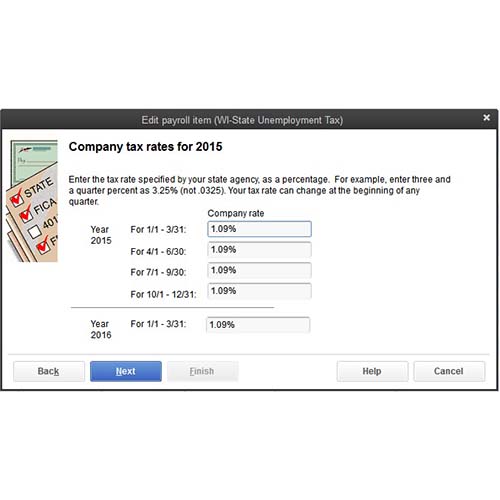

- Click Next twice and you will be at the Company Tax Rates window to enter the new 2016 rate. On the fifth line labeled “Year 2016 – For 1/1 – 3/31,” enter the new rate as a percentage, not a decimal (such as, 3.285%, not .03285). Continue clicking Next. Then, click Finish to save the entry. The rate will flow to the next calendar year.

If you have already prepared your Wisconsin or Minnesota Unemployment report and the amount that QuickBooks has calculated does not match the amount to pay on your report, you will need to make the following adjustment to your liability check.

- Create the liability check in QuickBooks with the wrong amount, but do not save it yet.

- On the bottom portion of the check window are two tabs. The Payroll Liabilities tab will display the wrong amount. To the left of the Payroll Liabilities tab is the Expenses tab. Click the Expenses tab and enter the expense account for your Wisconsin or Minnesota Unemployment tax (can be found by double clicking the WI (or MN)-Unemployment Company item in the payroll item list). Then, enter the difference as a negative to decrease the amount of the check or as a positive to increase the amount of the check.

- Click the Recalculate button and your check should be the correct amount.