Construction Industry Perspectives

Showing You How to Run a Successful Business From the Ground Up

Hawkins Ash CPAs Expands Affordable Care Act Reporting Service Nationwide

Hawkins Ash CPAs will now provide Affordable Care Act Forms 1095-C and 1094-C reporting support to businesses nationwide with the

Developments in Tax and Business-Construction Industry

Construction Salary Survey Results The 2015 Construction Craft Salary Survey conducted by the National Center for Construction Education and Research

2016 QuickBooks Training

You are invited to attend a complimentary QuickBooks desktop edition training event presented by Hawkins Ash CPAs. The training session

Construction Industry Perspectives Fall 2016

Our fall Construction Industry Perspectives newsletter is now available. Headlines in this edition include: Defining "Reasonable" Compensation New Overtime Rules

New Lease Accounting Standards

A new Accounting Standards Update (ASU) recently issued by the Financial Accounting Standards Board (FASB) will affect many construction industry

Turning Trash into Cash

Construction sites generate large amounts of waste material. Typically, contractors end up paying to have this construction debris hauled away

Developments in Tax and Business

Increase in De Minimis Safe Harbor Threshold The tax law allows companies to make an election to expense certain “de

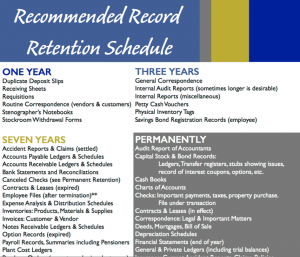

Does Your Company Have a Document Retention Policy?

Every company generates business documents. Cataloging and storing paper files, electronic documents, correspondence, and data used in business applications and