During this time of year when financials and tax returns are being prepared, you may want to clear out old outstanding checks from your checking account. If you want to void a check from a prior year or closed period, QuickBooks warns that it could affect the accuracy of your prior period reports and account balances.

If the check you are voiding is associated with an expense account, void the check and have QuickBooks enter journal entry adjustments. To perform this recommended option, follow these instructions:

1.) From the Check Register, find the check you want to void. Click on Edit and click Void Check. Then click Record.

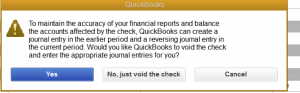

2.) QuickBooks message will pop up. Choose Yes. The original check is voided and amounts are changed to zero.

3.) QuickBooks will create two general journal entries.

- The first journal entry, dated the same day as the original check, duplicates the accounting entry of the original check. This assures no changes will be made to the prior period’s reports.

- The second journal entry, dated in the current period, reverses the accounting entry of the original check. This adds cash back to the checkbook balance in current period.

If you are voiding a check associated with non-expense accounts or items (a check used to purchase inventory items, a bill payment check, a paycheck, a payroll liability check), you should consult with your accountant.