With all the payroll changes in 2020, do not forget to reconcile Form W-3 to your quarterly Forms 941.

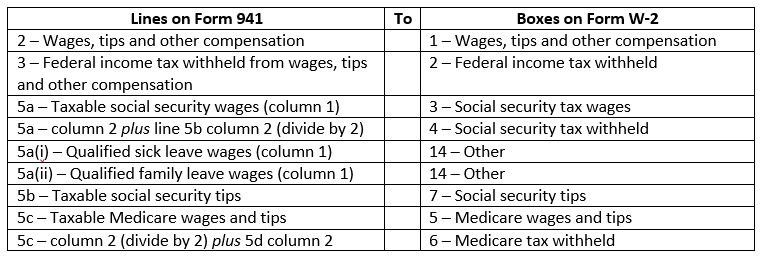

To reduce discrepancies between amounts on Forms W-2, W-3, and Forms 941, you should make sure the amounts on Form W-3 total amounts from Forms W-2. You should also reconcile Form W-3 with your four quarterly 941 returns by comparing the following amounts:

Make sure you retain your reconciliation information in case you receive inquiries from the Internal Revenue Service (IRS) or Social Security Administration (SSA).

These agencies reconcile your W-2s against your 941s, and if:

- W-2s are less than Form 941 – SSA will send you a notice

- W-2s are more than Form 941 – IRS will send you a notice

There are many ways to reconcile these amounts. Whether it’s an excel spreadsheet, a calculator tape, or a handwritten computation, verify your numbers before you submit anything to the IRS or SSA. Please contact Hawkins Ash CPAs with questions.